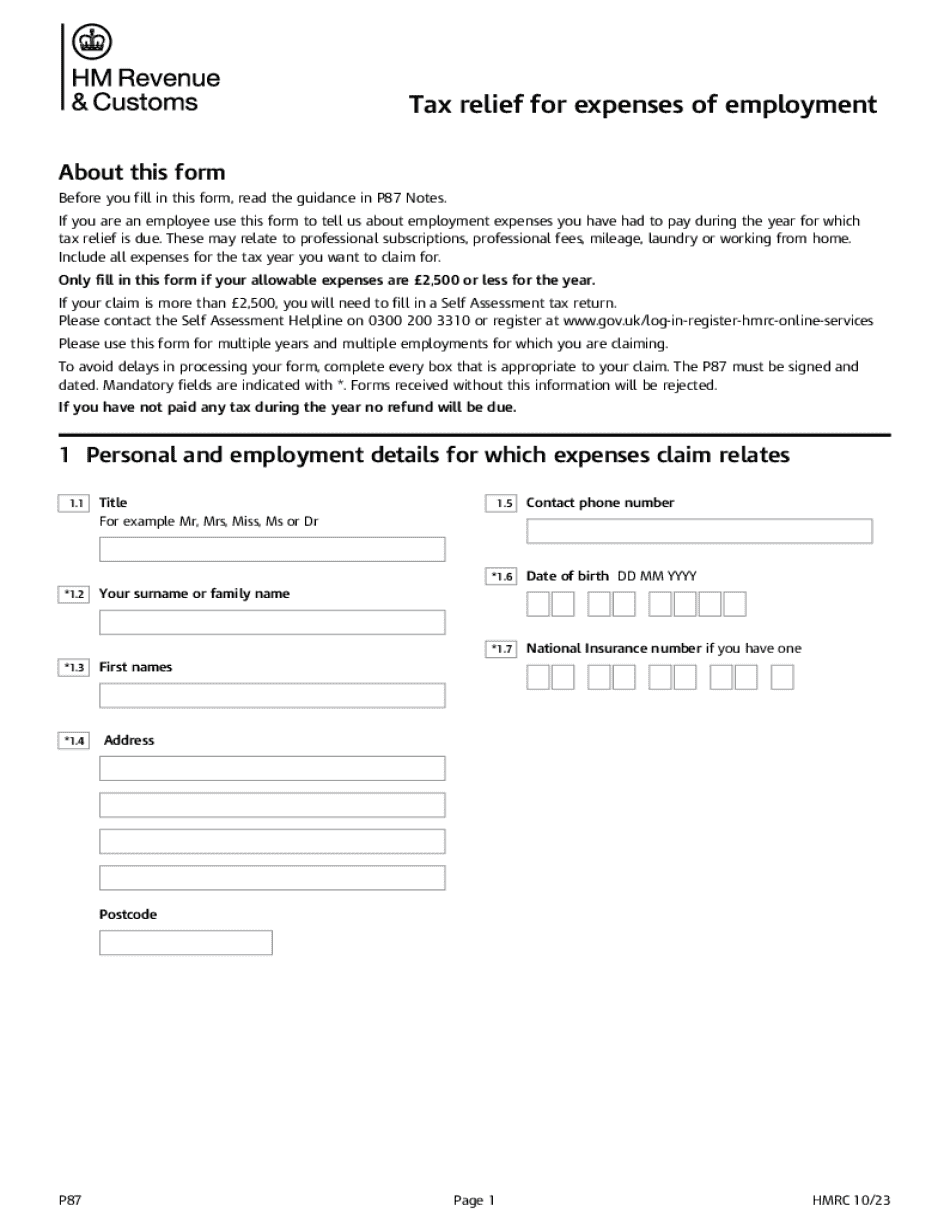

Hi so today we're looking at how to fill in form P 87 to claim income tax relief on any expenses that you have incurred on during your employment on behalf of your employment which your employer doesn't reimburse you for. First, Google Form pH 7 brings you of this page on HMRC's website. You can claim online by post or by phone. This is the online form. First, I'd take a look at the information you'll need and if you carry down in mileage for work, I need to train into customers, you can claim the tax relief through this form. Any firm hotel means on traveling and also for any equipment from work, upon working under these perfect 19 times. So if you click on using the online form, and then you will see that you can claim certain tax relief. If you click on to start now this form the page that's missing is your login details you need to have a government gateway which will take about five or ten minutes to set up. And then you can start your phone. If you started with an error, you can go back and write it again. This goes through your information that you can claim back here. And if you click on the forms that now it's quite intuitive, so you use a confirmation if not claim tax relief on these before save and continue now. You need to ensure that you claim in for the right tax year. If you were working home from the 23rd of March and 2020, it will fall in the 6th of April 3rd to the 5th of April twenty year. If you purchased items after the sixth of April, and then you go into the current tax year, you need...

Award-winning PDF software

How to prepare P87 Claim Form

About P87 Claim Form

The P87 Claim Form is a document used by employed individuals in the UK who want to claim tax relief on certain work-related expenses. It allows employees to request tax rebates on expenses such as uniforms, tools, and membership fees for professional bodies. This form is used to claim expenses that were not reimbursed by the employer. Only those who are employed and pay tax through PAYE (Pay As You Earn) system are eligible to use this form. The form can be submitted online or by post to HM Revenue and Customs (HMRC).

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do P87 Claim Form, steer clear of blunders along with furnish it in a timely manner:

How to complete any P87 Claim Form online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our Assistance team.

- Place an electronic digital unique in your P87 Claim Form by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your P87 Claim Form from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing P87 Claim Form